Buzzfeednews.com, here.

Wednesday, December 05, 2018

Tuesday, December 04, 2018

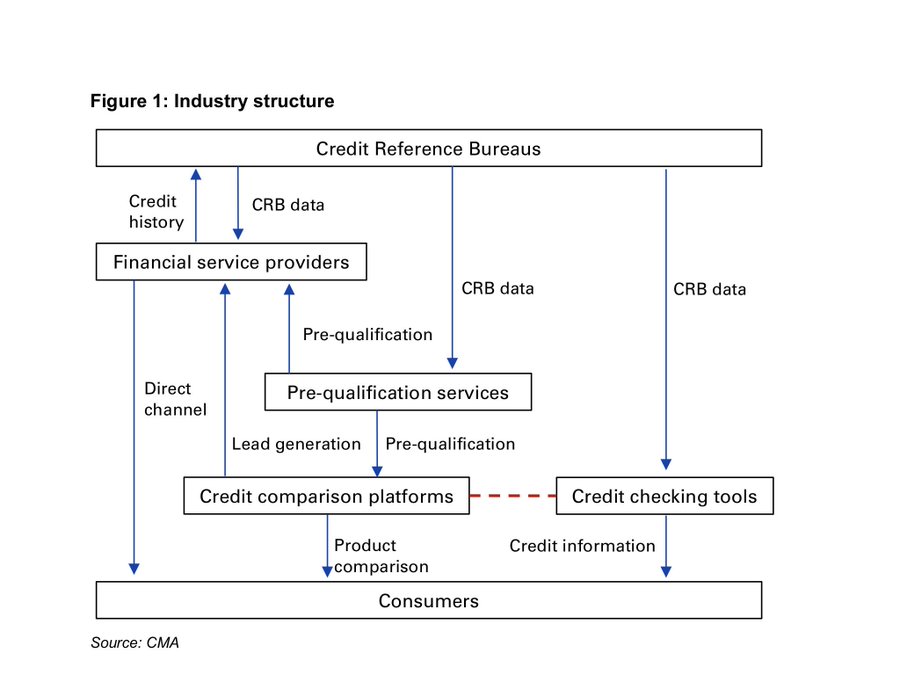

Experian/ClearScore

CMA, Provisional findings report here.

(What I find a bit surprising is the playing down of the PSD2-Open Banking effects)

(What I find a bit surprising is the playing down of the PSD2-Open Banking effects)

Monday, December 03, 2018

EU competition rules on vertical agreements – evaluation

EC, here.

Now Feedback period, Public Consultation follows (Q1 2019)

Now Feedback period, Public Consultation follows (Q1 2019)

Sunday, December 02, 2018

Saturday, December 01, 2018

Friday, November 30, 2018

Le Conseil constitutionnel sur la notion de “déséquilibre significatif”

Décision n° 2018-749 QPC du 30 novembre 2018, ici.

Thursday, November 29, 2018

What's in the water in Germany?

Competition Lore, with C. Beaton Wells and R. Podzun, Podcast here.

(Recorded before the Bundeskartellamt's Amazon investigation).

(Recorded before the Bundeskartellamt's Amazon investigation).

Wednesday, November 28, 2018

Zero-price markets: Updating the Analytical Toolkit

M. Botta, Presentation here.

- 1. COMPETITION POLICY IN ZERO-PRICE MARKETS UPDATING THE ANALYTICAL TOOLKIT MARCO BOTTA Joint meeting of the OECD Competition and Consumer Policy Committees Paris, 28th November 2018 Max Planck Institute for Innovation and Competition | Munich

- 2. Outline 2 • Updating the competition analytical tools: 1) Relevant market. 2) Market power. 3) Anti-competitive conducts. 4) Potential remedies. • Conclusions – questions for further debate.

- 3. Limits of the SSNIP test 3 • The relevant market is traditionally defined via the SSNIP test. • Problem: what is “small, but significant price increase” in a zero-price market? • ‘Free effect’ : when the reference price is zero, consumers will automatically switch to any competing product in case of price increase ➢ excessively broad definition of the relevant market. • Multi-sided markets: SSNIP test will limit market definition to one side of the market.

- 4. Alternative tools to define therelevant market 4 • Alternative tools follow a similar logic as the SSNIP test: 1) SSNIC (i.e. increase consumers’ costs): + data / attention ➢ + consumers’ costs. 2) SSNDQ (i.e. decline product quality): + data / attention ➢ - product quality. • Limits of the alternative tools in zero-price markets: 1) Quantification: +5% amount of personal data / attention? 2) Heterogeneous consumers’ preferences: what type of data/attention should we take into consideration? 3) Positive effects: + data transferred can increase the product quality. 4) SSNIC and SSDQ do NOT catch multi-sided markets.

- 5. Market power in zero-price markets 5 • Market power within the relevant market: element to trigger enforcement of competition policy (e.g. unilateral conducts, merger control, vertical agreements). • Traditional definition of market power: ability of the firm to raise prices above the competitive level. • ‘Free effect’ : in zero-price markets firms can never raise prices above 0 ➢ consumers would always switch to other products = NO firm has market power. • The market share has limited relevance to assess market power in zero- price markets.

- 6. Factors to estimate market power in zero-price markets 6 • A number of factors can be assessed to estimate the degree of market power in zero-price markets: 1) Attention degree: users’ attention on the Internet is a ‘scarce’ resource. 2) Direct and indirect network effects: number of users; product quality. 3) Multi-homing and switching costs. 4) Access to data ➢ possibility to purchase data from third parties. 5) Sunk investment costs. 6) Degree of innovation: a) Relevance of innovation in the market; b) Evidence of past radical innovations; c) Evidence of past entry.

- 7. Updating anti-competitive conducts 7 • Assessment of anti-competitive conducts based on ‘price’ should be revised in zero-price markets. • Cartels fixing the price at zero: shift from a per se prohibition to an effect analysis. • Predatory pricing ➢ what is ‘predatory’ in a zero-price market? 1) Fallacies in accordance with the current legal standards: a) EU: presumption of predation when prices are below average marginal costs. b) USA: requirement of likely recoupment in the same market. 2) Recoupment requirement should be always required, BUT extended to other ‘sides’ of the market.

- 8. Updating anti-competitive conducts 8 • Exploitative conducts in zero-price markets (EU): 1) Excessive pricing (i.e. asking ‘too much data’) ➢ NOT relevant. 2) Discriminatory pricing ➢ NOT relevant. 3) Unfair contractual clauses: relevant in zero-price markets a) Clauses ‘unilaterally’ imposed by the dominant firms (e.g. social network unilaterally modified the data protection terms). b) ’Unfair’: clauses ‘un-related’ to the product, and outside the ordinary commercial business practices (e.g. users’ data are transferred to third parties without the user’s consent). c) Relationship with consumer and data protection law: open question.

- 9. Competition law remedies in zero-price markets 9 • Zero-price markets pose new challenges to the application of the traditional antitrust toolkit ➢ infringement decision + fine is NOT an effective remedy. • Structural v. behavioural remedies: 1) Structural remedies (e.g. un-bundling; divestiture of a subsidiary): NOT efficient ➢ negative effect on direct network effects and product quality. 2) Behavioural remedies: the NCA ‘guides’ the firm in terms of competition law compliance: a) Tailor-made ➢ designed in cooperation with the firm (i.e. commitments); b) Possible periodic revision ➢ adaptation to the market dynamics. c) Need of monitoring. d) Risk of market regulation ➢ overlap with data protection and consumer law.

- 10. Behavioural remedies in zero-price markets 10 • Examples of behavioural remedies in zero-price markets: 1) Increase consumers’ awareness (e.g. increase transparency of the contractual terms; info about the personal data collected); 2) Setting minimum standards of data protection terms (e.g. max. duration of data storage); 3) Giving consumers the opportunity to periodically revise the consent to the processing of their personal data; 4) Right to data portability.

- 11. Relationship with sector-regulation 11 • Antitrust remedies can clarify unclear aspects in data/consumer law protection. • Cooperation between NCA and data protection /consumer law authorities: 1) Exchange of information during the investigations; 2) Joint sector-inquiries; 3) Consultation in designing behavioural remedies. • Competition v. consumer / data protection remedies: 1) Advantage: antitrust remedies ensure higher degree of deterrence. 2) Disadvantage: definition relevant market and market power.

- 12. Conclusions – questions for further debate 12 • Are SSNIC and SSNDQ effective tools to define the relevant market? • What aspects should be taken into consideration to assess market power in zero-price markets? • How should the assessment of anti-competitive conducts be adjusted to the peculiarities of zero-price markets? • What type of competition law remedies could be introduced in zero-price markets? • What are the possible forms of cooperation between NCAs and sector regulators when it comes to designing the remedies?

- 13. 13 Thank you very much for your attention! marco.botta@ip.mpg.de

‘Principles of the Law Governing the Internet’

Members of the national Parliaments of: the Argentine Republic; the Kingdom of Belgium; the Federative Republic of Brazil; Canada; the French Republic; Ireland; the Republic of Latvia; the Republic of Singapore; and the United Kingdom of Great Britain and Northern Ireland, here.

Disinformation and ‘fake news’ (and FB privacy and antitrust)

House of Commons, Digital, Culture, Media and Sport International Grand Committee, here (both videos and transcripts).

Tuesday, November 27, 2018

Consumer-Lending Discrimination in the Era of FinTech

R. Bartlett, A. Morse, R. Stanton, N. Wallace, here.

Monday, November 26, 2018

3D printing and intellectual property futures

T. Birtchnell, A. Daly, T. Rayna and L. Striukova for the UK IPO, here.

Subscribe to:

Posts (Atom)

-

Centre for a Digital Society , Video here . These are my very rough talking points on pay or okay in full length (more than I actually had...

-

EDPS 20th Anniversar, Book here .

-

C. Bergstrom and J. West, here .

-

Public Knowledge, here .

-

Yesterday, I had the pleasure to teach a 90-minute class on the DMA for Chinese competition officials. Despite a) being just after lunch b) ...

-

J. Almunia, here . From the speech: " Fair and robust competition rules mean – among other things – integrating those markets which, ...